MAC Stock Analysis Overview

Finviz Stock Screener. Who it’s for: All levels. Price: Free for the basic version, $25 a month for Finviz Elite. By far one of the most intuitive and easiest stock screening tools available. Aptistock is your free stock market analysis software, free stock software and stock software. It make online stock trading has never been easier. With it you can get free EOD, free charting tools. It can also be use to analysis option, future, forex, unit trust and mutual funds data. Come on, beat the market and get high return and high yeild. Stock Rover is the best free stock software for growth, dividend & value investors with a 10-year financial database and industry-leading screening, research, and portfolio management capabilities. TC2000 has excellent chart analysis and real-time Stock and ETF market scanning for the USA & Canada.

What this means: Macerich Company (MAC) gets an Overall Rank of 56, which is an above average rank under InvestorsObserver's stock ranking system. Our system considers the available information about the company and then compares it to all the other stocks we have data on to get a percentile-ranked value. MAC's 56 means that it ranks higher than 56% of stocks.

Who this matters to: Overall Ranking is a comprehensive evaluation. It considers technical and fundamental factors and is a good starting point for evaluating a stock.

Download this app from Microsoft Store for Windows 10 Mobile, Windows Phone 8.1. See screenshots, read the latest customer reviews, and compare ratings for Stockmarket - Technical analysis.

MAC Fundamental Analysis

Upgrade to Premium to unlock Fundamental Ranking

MAC Short-Term Technical Analysis

Upgrade to Premium to unlock Short-Term Technical Ranking

MAC Long-Term Technical Analysis

Upgrade to Premium to unlock Long-Term Technical Ranking

MAC Analyst Ranking

Upgrade to Premium to unlock Analyst Ranking Analysis

MAC Valuation Ranking Analysis

Upgrade to Premium to unlock Valuation Ranking

MAC Stock Sentiment Analysis

Upgrade to Premium to unlock Stock Sentiment Ranking

MAC Stock Analysis Overview

What this means: Macerich Company (MAC) gets an Overall Rank of 56, which is an above average rank under InvestorsObserver's stock ranking system. Our system considers the available information about the company and then compares it to all the other stocks we have data on to get a percentile-ranked value. MAC's 56 means that it ranks higher than 56% of stocks.

Who this matters to: Overall Ranking is a comprehensive evaluation. It considers technical and fundamental factors and is a good starting point for evaluating a stock.

MAC Fundamental Analysis

Upgrade to Premium to unlock Fundamental Ranking

MAC Short-Term Technical Analysis

Upgrade to Premium to unlock Short-Term Technical Ranking

MAC Long-Term Technical Analysis

Upgrade to Premium to unlock Long-Term Technical Ranking

MAC Analyst Ranking

Upgrade to Premium to unlock Analyst Ranking Analysis

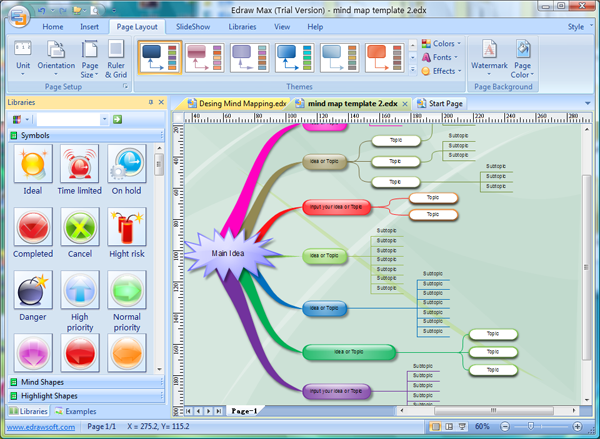

Stock Charting Software

MAC Valuation Ranking Analysis

Upgrade to Premium to unlock Valuation Ranking

MAC Stock Sentiment Analysis

Upgrade to Premium to unlock Stock Sentiment Ranking

Macerich Company (MAC) Analyst Forecast

MAC Price, Volume, Earnings, and Dividend Date

- Last Price$17.41

- Previous Close $16.71

- Change$0.70

- Open$16.99

- Volume2,927,260

- Avg. Volume (100-day)4,064,323

- Market Cap3,708,484,914

- Days Range16.82 - 17.67

- 52-week Range6.42 - 25.99

- Dividend Yield 3.45%

- Ex. Dividend Date 08/18/21

- P-E—

- EPS—

- Earnings Date 11/02/21

- SectorReal Estate

- IndustryREIT - Retail

- Avg. Analyst Rec. Premium

- Beta1.931

- PEG Ratio—

Macerich Company (MAC) Company Description

The Macerich Company is an S&P 500 company that invests in premium mall assets. The company owns 29 regional malls in its consolidated portfolio and 19 regional malls in its unconsolidated portfolio along with six power centers and six other real estate assets. The company's total portfolio has 50.6 million square feet gross leasable area and averaged $801 sales per square foot for the past 12 months, with the consolidated portfolio averaging $646 sales per square foot and the unconsolidated portfolio averaging $998 sales per square foot.

Macerich Company (MAC) Stock Chart

Free Stock Analysis Software Mac

My Watchlists

Follow Your Favorite Stocks

Top Stocks in REIT - Retail

| Company | Price |

| Simon Property Group (SPG)(SPG) | $133.14 |

| Brixmor Property Group Inc (BRX)(BRX) | $23.08 |

| Kimco Realty Corp (KIM)(KIM) | $21.74 |

| Whitestone REIT (WSR)(WSR) | $10.00 |

| Federal Realty Investment Trust (FRT)(FRT) | $121.05 |

| Regency Centers Corp (REG)(REG) | $69.28 |

| Entertainment Properties Trust (EPR)(EPR) | $51.97 |

| Cedar Realty Trust Inc (CDR)(CDR) | $22.33 |

| Netstreit Corp (NTST)(NTST) | $24.12 |

| Site Centers Corp (SITC)(SITC) | $16.14 |